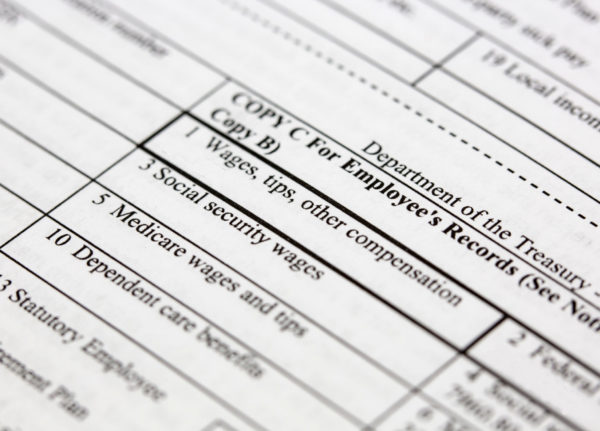

If you’re an executive or other key employee, you might be rewarded for your contributions to your company’s success with compensation such as restricted stock, stock options, or nonqualified deferred compensation (NQDC). Tax planning for these forms of “exec comp,” however, is generally more complicated than for salaries, bonuses and traditional employee benefits. And planning […]

Accelerating deductible expenses, such as property tax on your home, into the current year typically is a good idea. Why? It will defer tax, which usually is beneficial. Prepaying property tax may be especially beneficial this year, because proposed tax legislation might reduce or eliminate the benefit of the property tax deduction beginning in 2018. […]

A fundamental tax planning strategy is to accelerate deductible expenses into the current year. This typically will defer (and in some cases permanently reduce) your taxes. But there are exceptions. One is if the additional deductions this year trigger the alternative minimum tax (AMT). Complicating matters for 2017 is the fact that tax legislation might […]

Many investors, especially more risk-averse ones, hold much of their portfolios in “income investments” — those that pay interest or dividends, with less emphasis on growth in value. But all income investments aren’t alike when it comes to taxes. So it’s important to be aware of the different tax treatments when managing your income investments. […]

How long will you take to collect the outstanding receivables that are reported on your balance sheet? Many companies take weeks or even months to collect invoices from customers. Fortunately, there are ways to convert them into cash now. Line of credit A line of credit can help bridge the “cash gap” between performing work […]

Various limits apply to most tax deductions, and one type of limit is a “floor,” which means expenses are deductible only if they exceed that floor (typically a specific percentage of your income). One example is the medical expense deduction. Because it can be difficult to exceed the floor, a common strategy is to “bunch” […]

Are you the founder of your company? If so, congratulations — you’ve created something truly amazing! And it’s more than understandable that you’d want to protect your legacy: the company you created. But, as time goes on, it becomes increasingly important that you give serious thought to a succession plan. When this topic comes up, […]

By Stephen Ozen If you own a restaurant in California, chances are you’ve dealt with large parties before. Due to the elevated levels of attention and service required for parties of 6 or more, there is typically gratuity added to the bill. While it may sound like it makes sense to ensure a certain amount […]

Charitable giving allows you to help an organization you care about and, in most cases, enjoy a valuable income tax deduction. If you’re considering a large gift, a non-cash donation such as appreciated real estate can provide additional benefits. For example, if you’ve held the property for more than one year, you generally will be […]

At back-to-school time, much of the focus is on the students returning to the classroom — and on their parents buying them school supplies, backpacks, clothes, etc., for the new school year. But let’s not forget about the teachers. It’s common for teachers to pay for some classroom supplies out of pocket, and the tax […]

Most of the talk about possible tax legislation this year has focused on either wide-sweeping tax reform or taxes that are part of the Affordable Care Act. But there are a few other potential tax developments for individuals to keep an eye on. Back in December of 2015, Congress passed the PATH Act, which made […]

Now that Affordable Care Act (ACA) repeal and replacement efforts appear to have collapsed, at least for the time being, it’s a good time for a refresher on the tax penalty the ACA imposes on individuals who fail to have “minimum essential” health insurance coverage for any month of the year. This requirement is commonly […]