A critical deadline is approaching for many of the businesses that have received loans under the Paycheck Protection Program (PPP), which was created in March 2020 by the CARES Act. If these borrowers don’t take action before the deadline expires, their loans will become standard loans, and the borrowers could be responsible for repaying the […]

In a recent press release, the Social Security Administration (SSA) advised employers to use its Business Services Online (BSO) Portal to correct employee name and Social Security number (SSN) errors. Doing so will ensure accurate wage reporting for employees. In addition, the SSA announced that it will no longer mail Employer Correction Request Notices (EDCORs) […]

As weather-related events continue to occur with great frequency and severity across the country, it’s possible that one of your 401(k) participants might request a hardship distribution to pay for home repairs. Employers that sponsor 401(k) plans must be prepared to properly determine whether the damage to a participant’s home qualifies for the casualty loss […]

The American Rescue Plan Act (ARPA), signed into law earlier this year, amended and extended the tax credits available to eligible employers that provide paid sick and family leave. This relief is consistent with the COVID-related leave originally provided under the Families First Coronavirus Response Act enacted in March of 2020. Just last month, the […]

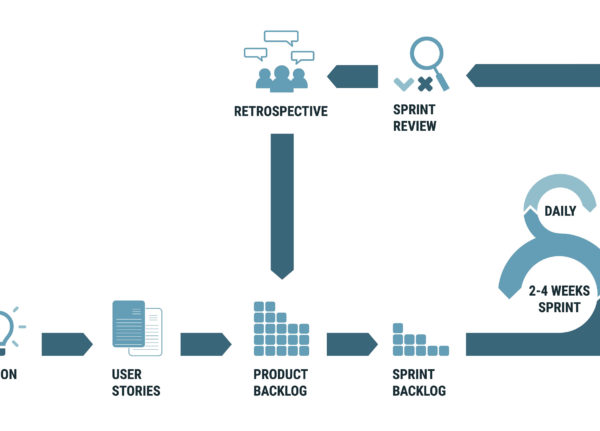

Agility — or the ability to react quickly — is essential to surviving and thriving in today’s competitive landscape. Though agile techniques were originally used in the realm of software development, this concept has many applications in the modern business world, including how companies approach their internal audits. Here’s an overview of agile auditing and […]

The IRS just released its audit statistics for the 2020 fiscal year and fewer taxpayers had their returns examined as compared with prior years. But even though a small percentage of returns are being chosen for audit these days, that will be little consolation if yours is one of them. Latest statistics Overall, just 0.5% […]

Are you age 65 and older and have basic Medicare insurance? You may need to pay additional premiums to get the level of coverage you want. The premiums can be expensive, especially if you’re married and both you and your spouse are paying them. But there may be a bright side: You may qualify for […]

As mitigation measures related to COVID-19 ease, it will be interesting to see which practices and regulatory changes taken in response to the pandemic remain in place long-term. One of them might be relief from a sometimes-inconvenient requirement related to the administration of 401(k) plans. A virtual solution In IRS Notice 2021-40, the IRS recently […]

Many types of businesses — such as homebuilders and manufacturers — turn raw materials into finished products for customers. Production is a continuous process. So, any work that’s been started but isn’t yet completed before the end of the accounting period is reported as work in progress (WIP) under U.S. Generally Accepted Accounting Principles (GAAP). […]

Married couples may not be able to save as much as they need for retirement when one spouse doesn’t work outside the home — perhaps so that spouse can take care of children or elderly parents. In general, an IRA contribution is allowed only if a taxpayer earns compensation. However, there’s an exception involving a […]

Timing counts in financial reporting. Under the accrual method of accounting, the end of the accounting period serves as a strict “cutoff” for recognizing revenue and expenses. However, during the COVID-19 pandemic, managers may be tempted to show earnings or reduce losses. As a result, they may extend revenue cutoffs beyond the end of the […]

The “sandwich generation” is a large segment of the population. These are people who find themselves caring for both their children and their parents at the same time. As a result, estate planning — which traditionally focuses on providing for one’s children — has expanded in many cases to include one’s aging parents as well. […]